To reduce discretionary and committed costs, analyze current expenses and prioritize necessary spending, then implement cost-saving measures. Evaluating and adjusting discretionary and committed costs can help streamline finances and improve overall budget efficiency.

By identifying areas where costs can be reduced or eliminated, businesses can create a more sustainable financial strategy while maintaining necessary expenditures. Reducing discretionary and committed costs is crucial for businesses aiming to improve their financial health. By effectively managing these costs, companies can enhance their overall profitability and competitive edge.

Implementing strategic cost-cutting measures allows businesses to optimize their resources while maintaining the quality of essential services and operations. This proactive approach also enables organizations to adapt to evolving market conditions and economic challenges, ultimately fostering long-term sustainability and growth.

Credit: medium.com

Identifying Discretionary Expenses

Understanding the Difference: Discretionary expenses are optional, while committed costs are essential.

Examples of Discretionary Expenses: Dining out, entertainment, shopping for non-essential items.

Credit: www.linkedin.com

Strategies To Reduce Discretionary Expenses

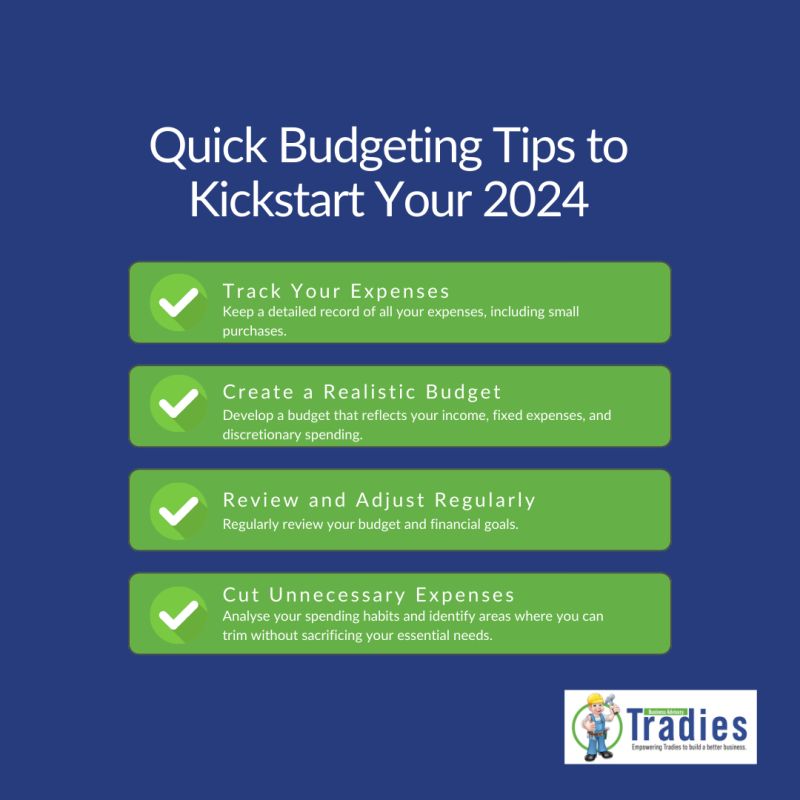

Reducing discretionary and committed expenses can help improve financial stability. Evaluate your spending habits to identify areas where you can cut back. Set clear priorities and be willing to make sacrifices to achieve your financial goals. Consider the value of each expense and determine if it aligns with your priorities. Be mindful of impulse purchases and seek alternative, cost-effective options when possible. By continuously reassessing your spending habits and making intentional choices, you can create a more sustainable and manageable financial situation.

Managing Committed Expenses

Identify Essential vs. Non-essential: Start by categorizing expenses into essential and non-essential. Essential costs are crucial for operations, while non-essential expenses are discretionary. Negotiate Better Deals: Review contracts to identify negotiation opportunities. Renegotiating terms with suppliers and vendors can lead to cost savings.

Creating A Budget And Tracking Expenses

To reduce costs, create a budget plan and use technology for expense tracking. Monitor spending regularly to stay within budget.

Credit: fastercapital.com

Conclusion

By implementing strategic cost reduction strategies, both discretionary and committed costs can be effectively minimized. Embracing a proactive approach towards identifying inefficiencies and optimizing resources is key. Remember, constant monitoring and adaptation are crucial in achieving sustainable cost-saving goals. It’s time to take control of your costs for future success.